Recently added scams

Recent blog posts

- Confirm Your Account (American Express scam email)

- Instagram name change...

- Getting constant messages through your contact form?

- Own A Small Business? Beware Of These Money And Currency Scams!

- Did my bank send me this email or is that a scam?

- Cryptocurrency Scams: Don’t Become a Victim

- Online Customer Loyalty Scheme Or Just A Big Scam?

- Domain Name Scams – What You Need To Know To Protect Your Website And Business

- Saving Seniors from Online Scams

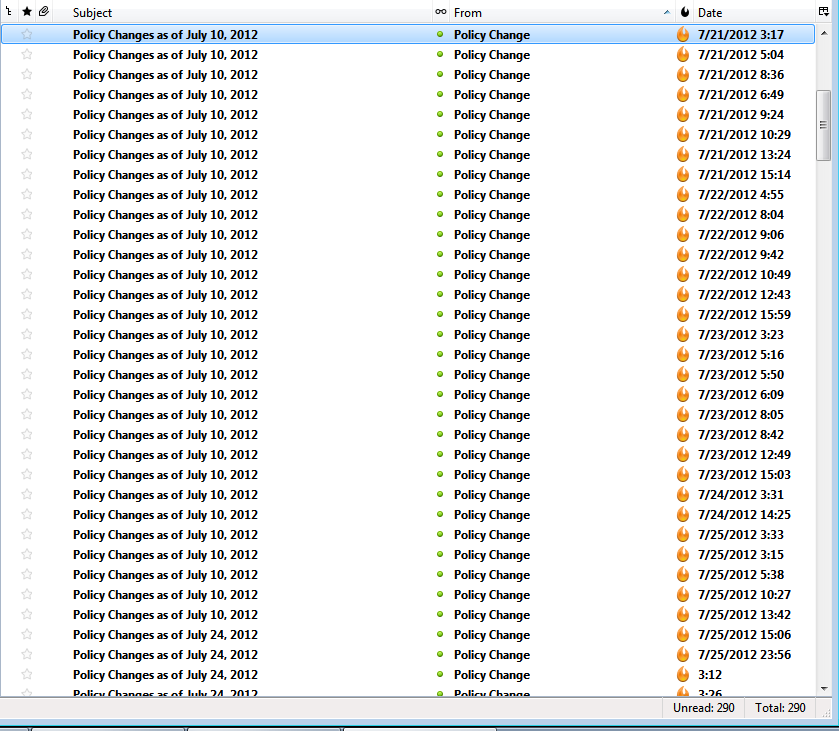

- Insurance Policy Change (July 2012)